2022-07-13 11:48:45

2022-07-13 11:48:45

636

636

SSDs are the core components of the three major components of ICT infrastructure, storage, and one of the core components of the digital economy.

Globally, the market size of memory chips will reach US$2021.2023 billion, US$1552.1804 billion and US$2196.22 billion respectively from 5 to 16, with an increase of 2.21%, 7.2021% and 56.41%, respectively. Among them, the DRAM market size in 2021 accounts for about 1620%, and the NAND Flash market size accounts for about 29% (IC Insights data). In addition, according to the CFM flash memory market, the global storage market size will reach $945 billion in 675, an increase of 100%, of which DRAM is $<>.<> billion and NAND Flash is $<>.<> billion. The figures from the two research institutions are similar, with a difference of $<> billion.

At present, the global memory chip market is mainly occupied by South Korea, Europe, the United States and Taiwan, with a high concentration of heads. Overseas manufacturers occupy most of the market share by virtue of their first-mover advantage and brand advantage in the end market.

Chinese mainland semiconductor storage industry started late, appeared in various storage fields to compete directly with well-known companies and break through overseas technology monopoly companies, and gradually narrowed the gap with overseas manufacturers in technology. In 2021, the market size of China's memory chips will reach 5494.59 billion yuan, accounting for <>% of the global memory chip market share (CCID Data).

However, it is worth noting that China's SSD market will still face uncertainties including short-term supply chain shocks, Sino-US economic and trade frictions and changes in the global market structure, requiring enterprises and markets to strengthen R&D autonomy and supply chain diversification.

This paper comprehensively analyzes the current situation of China's SSD market, and analyzes the advantages and disadvantages of current core enterprises from a technical point of view. It is worth noting that due to the different strength scale of domestic enterprises and different business fields, we are not strictly divided according to the CSSD (consumer) and ESSD (enterprise) dimensions, nor are we divided according to the DRAM, NAND Flash, NOR Flash, EEPROM dimensions. All data are attributed to the source.

Definition of SSD

As we all know, according to the core storage medium classification, memory is divided into three categories: optical memory, semiconductor memory and magnetic memory. Typical optical memory products are CD, DVD; Semiconductor memory cores are RAM (volatile) and ROM (non-volatile), often referred to as SSD SSDs are one of them. Typical products for magnetic storage are mechanical hard disks.

Simply put, solid-state drives (SSDs) are semiconductor memories with flash memory as storage media, which have the advantages of fast read and write speed, low latency, and good shock resistance compared to mechanical hard disks (HDDs), and their proportion of shipments in the global hard disk market continues to increase, and in 2020, they exceeded HDD shipments for the first time.

(Picture from iResearch report)

(Picture from iResearch report)

SSD products are mainly divided into two categories: consumer and enterprise. The consumer category is entering more Internet of Vehicles and electronics industries from the original consumer markets such as PCs and notebooks. The end customers of enterprise-level SSDs are mainly distributed in cloud computing, Internet, government, finance and energy industries, which have more stringent requirements for SSD products in terms of performance, capacity, service life, reliability, compatibility and enterprise-level features.

From the perspective of computer system structure, the host conveys data commands to the SSD through the interface through the file system and the underlying driver, and the data is written and read in the flash memory block (NAND) after the FTP (Flash Translation Layer) address translation inside the SSD.

Overall, China's SSDs are growing rapidly, and the corresponding amount of stored data has also developed from 1bit to 3bit and 4bit; The flash memory architecture has developed from 2D to 3D, and the number of stacking layers has continued to increase, currently approaching 200 layers; The interface is also converted to PCIe + NVMe, and the protocol is constantly converted.

Six core competencies

It is generally believed that the core technology of SSD is the main control, firmware and flash memory particles, in addition to these, the ability of manufacturers to integrate design, testing, production, customization and other aspects of the whole process is crucial.

1. Controller or chip. One of the three most important components of SSD, the controller is essentially a Processer (processor), based on ARM/RISC architecture, responsible for data transfer, such as connecting flash memory chips and external SATA interfaces; Complete various instructions inside the SSD, such as GC, Trim, etc. Therefore, the quality of the main control chip directly determines the quality of the SSD. Because of this, the technical threshold of the main control chip is very high, there are not many well-known brands, common brands such as Silicon Wing, Marvell, Samsung, the vast majority of which are controlled by upstream enterprises.

2. Flash memory particles. Two of the three most important components of an SSD. Flash memory is a non-volatile storage medium that is measured in fixed-size chunks. There are many types of flash memory particles, and the most commonly used is NAND Flash Memory. According to the density of flash memory, NAND particles can be divided into: SLC (single-layer memory unit), MLC (double-layer memory unit), TLC (three-layer storage unit) and QLC (four-layer storage unit), with larger and larger capacities and lower costs. Flash memory particle structure and working principle are extremely complex, more difficult than the development of controllers, there are very few mainstream brands, common such as Samsung, Kioxia, China's Yangtze River Storage is struggling to catch up.

3. Firmware algorithm. Three of the three most important components of an SSD. The controller and storage particles constitute the flesh of the SSD, the soul lies in the firmware, how the controller and the storage particles are perfectly compatible, to achieve efficient conduction with external interfaces, the core lies in the firmware. Manufacturers with controller development capabilities generally develop firmware algorithms independently. Mainstream controller manufacturers are also providers of firmware algorithms, such as Longsys in Shenzhen, China and Changxin in Hefei.

4. Integrated production capacity. Except for a very small number of manufacturers with a full set of technical production capabilities from controllers, firmware algorithms to flash memory particles, such as Samsung, the vast majority of manufacturers in the SSD field only have one or two core capabilities. How to organically integrate the core components of different manufacturers tests the integrated production capacity of an SSD manufacturer, packaging, testing, production, yield rate, each indicator is a symbol of technical strength and financial strength. A very small number of manufacturers in China have this capability, concentrated in Taiwan and other regions, such as Phison Electronics in Taiwan, Transcend, and Meilian Information in Shenzhen, China.

5. Product maturity. Product maturity cannot be verified in the laboratory, and there is only one way to verify maturity, that is, user scale. Only by continuous practice can we continuously optimize. Matching product maturity is accumulation, word of mouth, and an important indicator after market verification, which is related to standards, patents, talent reserves, and the relationship between upstream and downstream. The ADATA, Rainbow, and Kingston in the ESSD of Taiwan have advantages. CSSD's Huawei and most ecosystem-oriented vendors have such capabilities, such as Yealink Information, Guoke Micro, and Yangtze River Storage in Shenzhen, China.

6. Customization ability. This test is the manufacturer's flexible development, production capacity, and ability to keenly capture new markets. Especially in the ESSD industry, in recent years, the rise of cloud data centers, OEM manufacturers of various computing terminals, Internet-oriented terminals, new finance and new energy, automotive electronics application scenarios are becoming more and more abundant, coupled with the integration of AI and other technologies, a single SSD is moving towards the integration of the entire industry chain. Such as Guoke Micro, China Shenzhen Yilian Information, Hefei Changxin, etc.

Four metrics to measure SSD businesses

If SSDs are included in the category of chips, from a global perspective, the ultimate competition point of integrated circuits is the comprehensive strength between industrial chains. To develop, China's chip companies must make breakthroughs in the three core links of design, manufacturing, packaging and testing, as well as IP cores, EDA, equipment, materials and other supporting links.

The reality is that most of the market share is occupied by international giants, domestic manufacturers are relatively scattered, the number of personnel is small, and there are some lack of key modules, advanced process support, IP reserves and other aspects.

We do not fully count, as long as there are SSD manufacturers with a certain aspect of capabilities, whether it is design or simple OEM processing, or have the core main control, firmware production capacity, integrated production capacity, or capital level equity cross, local support enterprises but actually no technical content of enterprises, there are about 100 enterprises.

According to the actual situation, we score the company portrait according to the following dimensions, and 5 stars is a full score.

Brand advantage: This indicator is determined according to the exposure news of the company, based on the positive or negative news of the company, and the brand image of the company in the industry.

Development prospects: According to the company's development strategy, business adjustments, personnel changes, etc., this indicator examines the company's future prospects. For example, some companies are obviously using the "information innovation" to deceive local government subsidies.

Technical advantages: comprehensive production capacity, core technical personnel capabilities, sales and other indicators, especially the manufacturing advantages of main control, firmware and solutions, product richness, etc. In the current context, the autonomy of the enterprise is also measured.

Ecological advantages: the capabilities of upstream and downstream ecosystems. As mentioned earlier, the upstream of the ecosystem determines the price, quality, technical route, etc. of the product, and the downstream determines the ability to sell channels, solutions and customization, which in turn affects the bargaining power of the upstream.

First-line foreign manufacturers

In China's SSD market, there is no way around upstream particle manufacturers, such as Samsung, Hynix, Micron, Kioxia, Western Digital, and more than 95% of China's local SSD manufacturers come from these manufacturers. Moreover, these manufacturers have complete integrated design capabilities, and are far ahead in design, technology leadership, investment and revenue.

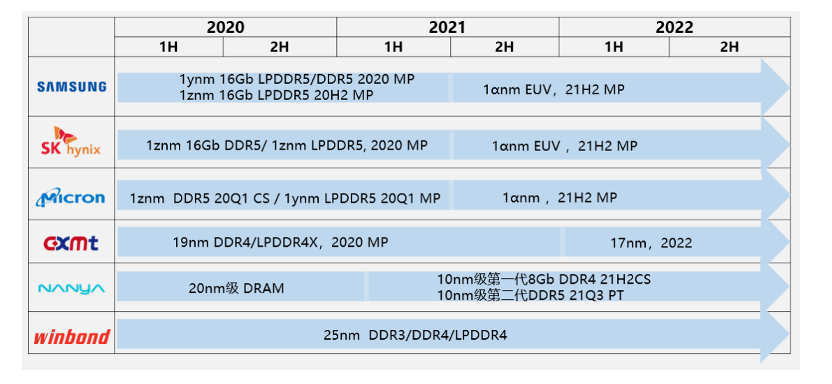

Let's look at the technology first. Starting in the second half of 2021, 3D NAND officially entered mass production of 176L. It is expected that the focus of major manufacturers in 2022 will be on increasing the proportion of high-stack 3D NAND product production, and 2023 is expected to see more than 200 layers of stacked products. In terms of DRAM, 1znm became the main DRAM production technology in 2021 and will continue to 2022.

(Picture from CFM Market Report)

(Picture from CFM Market Report)

Investment. The new DRAM factories that can already be put into production in 2021 mainly include: Samsung P2, SK Hynix M16, Micron A3.